HEDGING CONTRACT Meaning and

Definition

-

A hedging contract refers to a financial agreement entered into by individuals or entities to minimize or offset potential risks and uncertainties associated with price fluctuations or adverse movements in the market. It is a common risk management strategy used by companies, investors, and traders to protect themselves against any potential losses.

Typically, a hedging contract involves two parties, where one seeks to reduce their exposure to certain risks and the other party agrees to assume those risks. The contract usually outlines specific terms and conditions, including the type of risk being hedged, the duration of the agreement, and the agreed-upon price or rate to mitigate potential losses.

Hedging contracts are commonly employed in various financial markets, such as commodities, currencies, interest rates, or stock markets. For instance, a company that relies heavily on a particular commodity may enter into a hedging contract to secure a fixed price for future purchases, guarding against any potential price increase. Similarly, investors trading foreign currencies may utilize hedging contracts to protect themselves from adverse currency exchange rate movements.

These contracts can take various forms, such as options, futures, swaps, or forward contracts. Each type offers different degrees of risk coverage and benefits, depending on specific circumstances and market conditions. Regardless of the form, the primary goal of a hedging contract is to reduce any potential losses and provide stability in an unpredictable and volatile market environment.

Common Misspellings for HEDGING CONTRACT

- gedging contract

- bedging contract

- nedging contract

- jedging contract

- uedging contract

- yedging contract

- hwdging contract

- hsdging contract

- hddging contract

- hrdging contract

- h4dging contract

- h3dging contract

- hesging contract

- hexging contract

- hecging contract

- hefging contract

- herging contract

- heeging contract

- hedfing contract

- hedving contract

Etymology of HEDGING CONTRACT

The word "hedging" comes from the Old English word "hegg" or "hegge", which referred to a fence or boundary formed by closely planted shrubs or bushes. This concept of creating a protective barrier or enclosure led to the development of the verb "to hedge" in Middle English, meaning to surround or enclose.

In finance, the term "hedging" is derived from this notion of protecting oneself or guarding against potential risks. A hedging contract, therefore, is a financial agreement or arrangement designed to mitigate the impact of adverse price movements or uncertainties in the market.

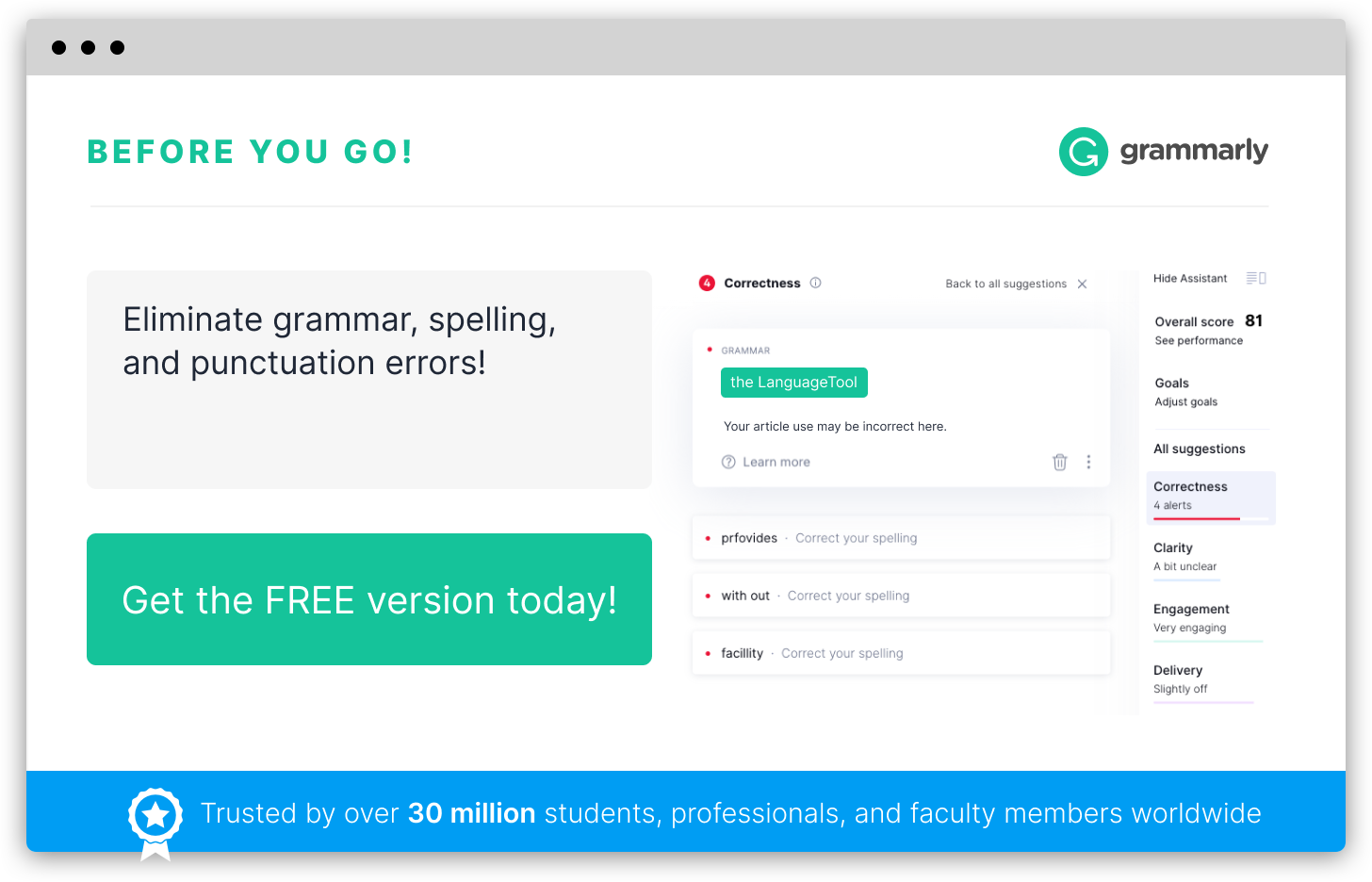

Infographic

Add the infographic to your website: